New, Lower HSR Thresholds and Proposed HSR Rule Changes

February 3, 2021

What Happened: The Federal Trade Commission published revised Hart-Scott-Rodino (“HSR”) thresholds in the Federal Register on February 2, 2021. Separately, HSR rule changes have been proposed that could potentially lead to more costly filings for investment funds.

The Bottom Line: The new thresholds are lower than current thresholds. They will apply to all transactions closed on or after March 4, 2021. Clients contemplating mergers or acquisitions need to be aware of the new thresholds. Companies may need to file with the Federal Trade Commission (“FTC”) and Department of Justice (“DOJ”) if the value of the deal exceeds $92 million.

Investment funds and master limited partnerships (“MLPs”) should also be on alert. If separate proposed HSR rule changes become effective, more funds may need to file notifications due to new aggregation rules. The new rules will also likely lead to more time-consuming and burdensome HSR notifications.

The Full Story:

HSR Thresholds

The FTC revises the HSR thresholds each year based on gross national product. Generally, under the revised thresholds, if the value of non-corporate interests, assets, voting securities or a combination thereof exceeds $368 million and no exemption applies, the parties must file. If the value of the transaction exceeds $92 million but is $368 million or less, then antitrust counsel will need to do a “size of person” analysis. Generally, an HSR filing will not be required unless one party to the transaction has total assets or annual net sales of $18.4 million or more and the other party has total assets or annual net sales of $184 million or more.

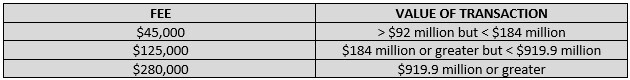

While the filing fees remain the same, the thresholds for those fees have also changed:

Proposed HSR Rule Changes

On September 21, 2020, the FTC announced potential changes to the HSR rules. The Premerger Notification Office (“PNO”) has indicated they will take comments received during the subsequent 60-day comment period seriously, meaning the PNO may further refine the proposed changes.

The proposed rules in their current form would add a new de minimis exemption for share acquisitions of 10% or less as an alternative to the current exemption for acquisitions made “solely for the purpose of investment.” The rules would also expand reporting requirements for acquiring investment funds by requiring them to aggregate their holdings with those of the broader fund family.

The proposed rules would significantly expand the HSR definition of “person” to include HSR “associates.” In practice, this would mean investment funds and MLPs would need to include substantial additional information in filings regarding entities under common investment management. This would also mean that newly formed funds and special purpose vehicles not controlled, for HSR purposes, by another entity would be subject to HSR reporting. These types of acquisitions were previously not subject to reporting requirements if valued at less than $368 million because they typically did not meet the HSR size of person test because they did not have the requisite assets or sales.

We will publish further advice on compliance with the new rules if passed. Implementation of the rules could take more than a year.

Conclusion

HSR analysis is fact-specific and requires a comprehensive and thorough understanding of both the statute and relevant regulations. Clients are advised to consult with antitrust counsel as early as possible to determine if an HSR filing is needed before closing the deal.